Transforming Soil into Leveraged Wealth and Economic Impact

Leverage a 4.5X deduction to generate significant tax savings while supporting sustainable development in Utah’s mineral-rich regions.

*The information here is for informational purposes only and is not financial advice. Please consult a financial professional, as we do not offer tax or investment advice.

Tap Into this Unique Opportunity

Transform Tax Burdens into Opportunities

Deduct 4.5X Your Contribution: Multiply your cash outlay to significantly reduce taxable income, up to 30% in the current year.

5-Year Carryforward: Any unused deductions can be applied in subsequent tax years, ensuring no benefit goes to waste.

Proven and Secure: Leverage a proven strategy with a success history, ensuring financial security and compliance for affluent individuals.

Produce Meaningful Economic Impact Maximizing Your Net Worth

Discover how your charitable contribution creates a positive impact locally and environmentally while helping you offset your contribution and reduce your total taxable income.

Meaningful Results for You and the Community

When you make a contribution, you generate a significantly greater impact for charities capable of maximizing the value of your donation.

Achieve financial gains aligned with your values of impact and legacy-building.

Simple and Proven

Designed for high-income earners, this strategy is supported by expert analysis and a history of compliance success.

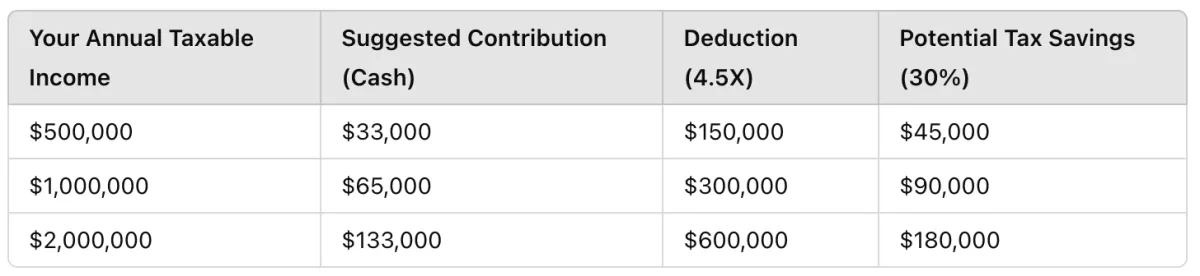

Your Results in Real Numbers

These examples show how much you could save by applying the deduction for that tax year.

Unused deductions roll forward for up to 5 years.

*Example savings are illustrative; consult your tax professional for personalized advice.

Backed by Expertise and Innovation

Contributions support sustainable mineral development in Utah.

Managed by financial and environmental experts, ensuring that your investment creates tangible impact.

Important Details

Contribution Limitations:

There’s no cap on participation, allowing you to tailor contributions to your financial goals.

Letters of Intent Due Dec. 22nd:

Opportunities to maximize this year’s deductions are closing soon.

ACT NOW to Ensure Tax Savings for 2024!

Testimonials

Jasmine Richards

The soil analysis was surprisingly thorough, really opened our eyes. Loved the workshops too—informative and hands-on. Great stuff for anyone curious about sustainable farming.

Monica Chandler

The workshops really opened my eyes, and the custom fertilization plans were a game-changer. Finally, something that works better than the rest!

Thomas Krazinski

The community development program provided essential skills and tools, greatly enhancing local agricultural practices and economic stability in our region.

What exactly is mineral-rich soil and why is it important

Mineral-rich soil contains a high concentration of essential nutrients and minerals that are crucial for plant growth and soil health. Managing it well leads to better agricultural yields and sustainability, which in turn contributes to better food security and economic conditions for communities.

How does the contribution multiply my deduction?

Just like when a retailer purchases an item in bulk to resell at a grocery store at a higher market rate, you acquire the minerals in bulk and contribute them to a qualified charity that gives you a fair market value (FMV) income deduction of the minerals donated.

How do I get started?

Schedule a consultation today to discuss your financial situation and how this strategy can provide immediate and long-term benefits.

What does the 4.5X deduction mean?

For every dollar contributed, you can deduct 4.5X that amount from your taxable income, subject to the 30% limit of your adjusted gross income.

What happens if I can’t use the entire deduction this year?

You can carry forward unused deductions for up to 5 years, ensuring you can benefit from the full impact of your contribution.

Who qualifies for this strategy?

High-income earners or businesses looking for significant tax savings while contributing to a sustainable initiative.

Financial Advisors, CPAs, CFOs, Accountants/Bookkeepers, and other relevant partners working with high-net-worth individuals.